Tax-saving Tips for 2025: A Complete Guide

As the financial year 2025-26 approaches, taxpayers are looking for effective strategies to save tax. The Indian Income Tax Act provides several deductions, exemptions, and investments that help reduce tax liability legally. This blog explores the best tax-saving tips and investments that can help individuals and professionals optimize their finances in 2025.

Understanding the Tax Regimes and Slabs for 2025

The New Tax Regime introduced updated income tax slabs effective from FY 2025-26:

| Income Range (INR) | Tax Rate |

|---|---|

| Up to ₹4 lakh | NIL |

| ₹4 lakh – ₹8 lakh | 5% |

| ₹8 lakh – ₹12 lakh | 10% |

| ₹12 lakh – ₹16 lakh | 15% |

| ₹16 lakh – ₹20 lakh | 20% |

| ₹20 lakh – ₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

Taxpayers can choose between the Old and New tax regimes based on eligibility and investment habits. The Old regime provides more deductions but has higher slabs, while the New regime offers lower slab rates but fewer deductions.

Key Tax-saving Tips for 2025

1. Maximize Section 80C Deductions (Up to ₹1.5 lakh)

Section 80C remains the most popular tax-saving provision. Eligible investments and expenses include:

- Equity Linked Savings Scheme (ELSS) mutual funds

- Public Provident Fund (PPF)

- Employee Provident Fund (EPF)

- National Savings Certificate (NSC)

- Life insurance premiums

- Principal repayment on home loan

- Children’s tuition fees

These can provide deductions up to ₹1.5 lakh per year, reducing taxable income substantially.

2. Invest in National Pension System (NPS) for Additional ₹50,000 Deduction

Beyond 80C, investors can claim an extra ₹50,000 deduction under Section 80CCD(1B) by investing in NPS, which also helps build retirement corpus.

3. Claim House Rent Allowance (HRA)

If living in a rented house, salaried individuals can claim HRA exemption, which depends on rent paid, salary, and city of residence. Proper documentation like rent receipts is necessary.

4. Consider Tax-saving Fixed Deposits and ULIPs

Tax-saving fixed deposits with a 5-year lock-in and Unit Linked Insurance Plans (ULIPs) offer additional avenues for deduction under Section 80C, combining investment returns with insurance coverage.

5. Leverage Health Insurance and Medical Expenses

Premiums paid for health insurance qualify for deduction under Section 80D. This includes premiums for self, family, and parents. It is useful for reducing tax while ensuring health protection.

6. Utilize Lesser-known Tax-saving Options

- Form a Hindu Undivided Family (HUF) for separate tax benefits.

- Plan leave encashment and retirement benefits tax-efficiently.

- Donations to political parties and NGOs can provide 100% or partial deductions under Sections 80GGB and 80GGC.

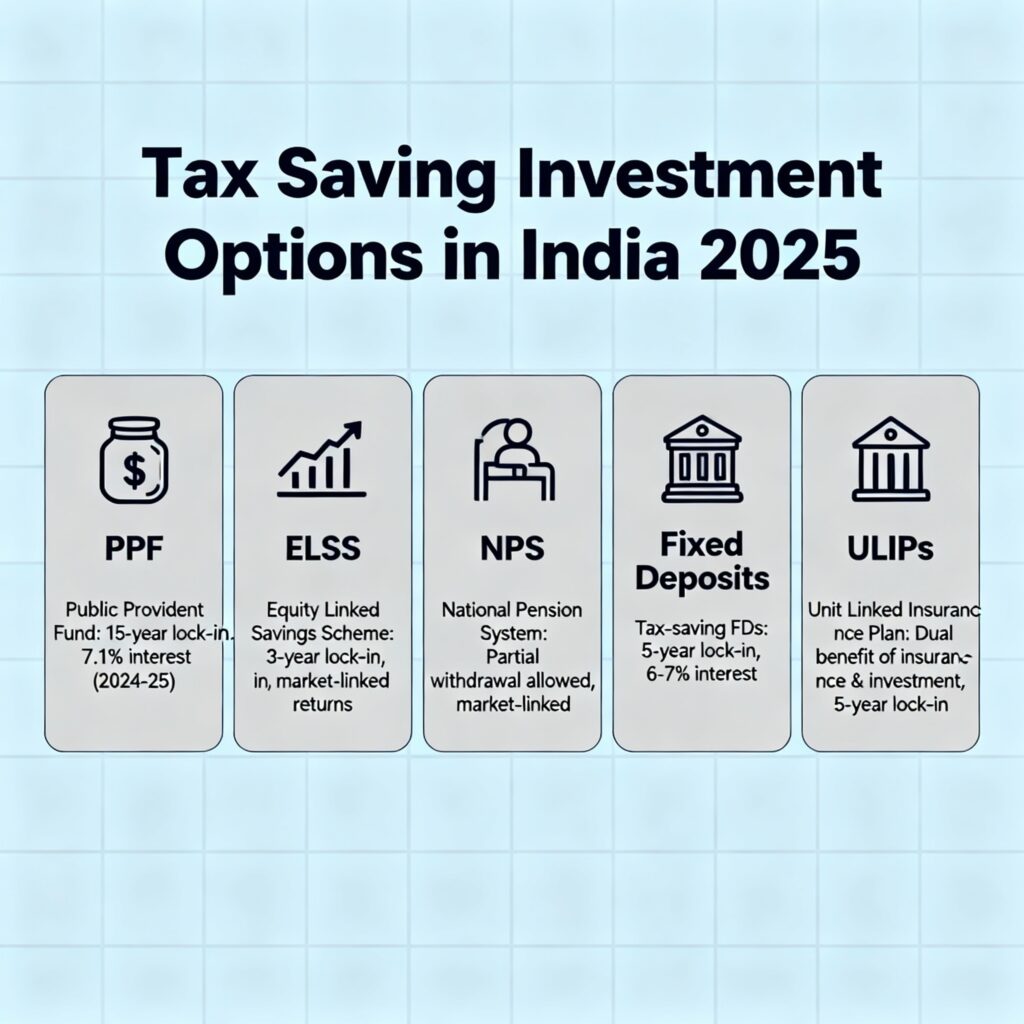

Best Tax-saving Investments for 2025

| Investment Option | Highlights | Lock-in Period | Tax Benefit Sections |

|---|---|---|---|

| Equity Linked Savings Scheme (ELSS) | High returns, shortest lock-in of 3 years | 3 years | 80C |

| Public Provident Fund (PPF) | Risk-free, attractive tax-free interest | 15 years | 80C |

| National Pension System (NPS) | Retirement-focused, additional ₹50,000 benefit | Till retirement | 80C and 80CCD(1B) |

| Tax-saving Fixed Deposits | Stable returns, 5-year lock-in | 5 years | 80C |

| Unit Linked Insurance Plans (ULIPs) | Insurance cum investment | Varies | 80C |

These instruments are proven ways to legally reduce tax while meeting financial goals.

Final Thoughts

Tax planning in 2025 requires understanding the latest slab rates, exemptions, and investment options. Choosing between the old and new regimes should be based on individual circumstances, expenses, and long-term goals. Investing wisely, claiming eligible deductions, and staying updated on tax laws can maximize savings and financial security.

indica gummies for sleep help you relax and rest naturally