Managing Debt Effectively: A Practical Guide

Debt can be useful when managed wisely, but if it spins out of control, it can create financial stress. Whether you’re dealing with credit cards, personal loans, or mortgages, learning how to manage debt effectively is the key to financial stability. This guide will help you build strong habits and strategies to take control of your finances.

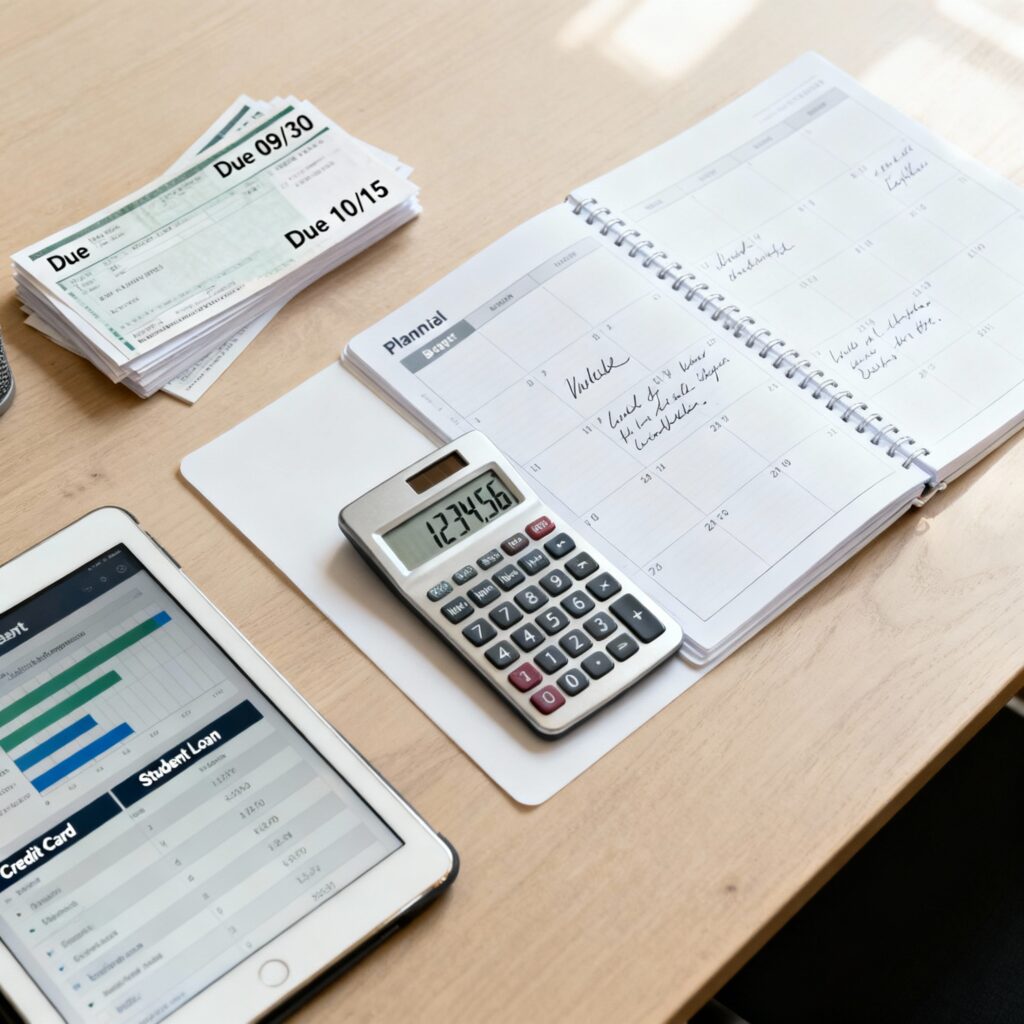

Understand Your Debt

The first step is knowing exactly where you stand. List out all your debts along with the interest rates, monthly payments, and due dates. This gives you a clear picture of how much you owe and which debts are costing you the most.

- Credit card balances

- Personal or auto loans

- Home mortgage

- Student loans

- Any outstanding bills

Prioritize High-Interest Debt

High-interest debts, such as credit cards, can grow quickly if not paid off. Prioritize paying these first while making minimum payments on other debts. By reducing high-interest debt, you save money in the long run and free up cash flow.

Create a Budget and Stick to It

Budgeting is the backbone of effective debt management. Track your income and expenses, then allocate funds toward debt repayment. Be realistic and remember to set aside money for essentials and small rewards to keep yourself motivated.

- Divide expenses into needs vs wants

- Use apps or spreadsheets to track spending

- Set aside emergency savings to prevent new debt

Methods to Pay Off Debt

Two popular strategies can help you stay disciplined:

- Debt Snowball Method: Focus on paying the smallest debt first while paying minimums on others. Once it’s cleared, move on to the next. This builds momentum and psychological motivation.

- Debt Avalanche Method: Focus on the highest-interest debt first. This saves more money on interest payments over time.

Choose the method that best suits your personality and financial situation.

Consider Professional Help if Needed

If your debt feels overwhelming, seek guidance. Financial advisors or credit counseling agencies can help you restructure payments, negotiate with lenders, and create a sustainable repayment plan.

Avoid Accumulating New Debt

Paying off debt is only half the battle. To stay debt-free, resist the urge to borrow for non-essential expenses. Use cash or debit whenever possible, and limit credit card usage to what you can pay off in full each month.

Build Strong Financial Habits

Once you gain control over debt, focus on building positive habits:

- Start an emergency fund with 3–6 months of living expenses

- Make saving automatic by setting up recurring transfers

- Invest gradually for long-term growth

- Review your credit score regularly

Final Thoughts

Managing debt effectively isn’t about quick fixes but creating a lifestyle of financial responsibility. With clear planning, discipline, and the right strategies, you can reduce your debt, avoid financial pitfalls, and build a path toward financial freedom.