Latest Trends in Fintech 2025

Fintech continues to disrupt the financial services sector with innovation at its core. The year 2025 is marked by rapid adoption of artificial intelligence, widespread embedded finance, regulatory developments, and novel payment technologies that collectively reshape the industry.

AI and Machine Learning Revolution

Artificial Intelligence (AI) and Machine Learning (ML) are central to fintech advancements. These technologies are improving fraud detection with real-time pattern analysis, enhancing personalized financial advisory through data-driven insights, and automating underwriting and credit scoring using diverse data signals like GPS and behavioral patterns. The arrival of agentic AI—autonomous, decision-making systems—is expected to transform fintech further, especially in software development and personal financial management.

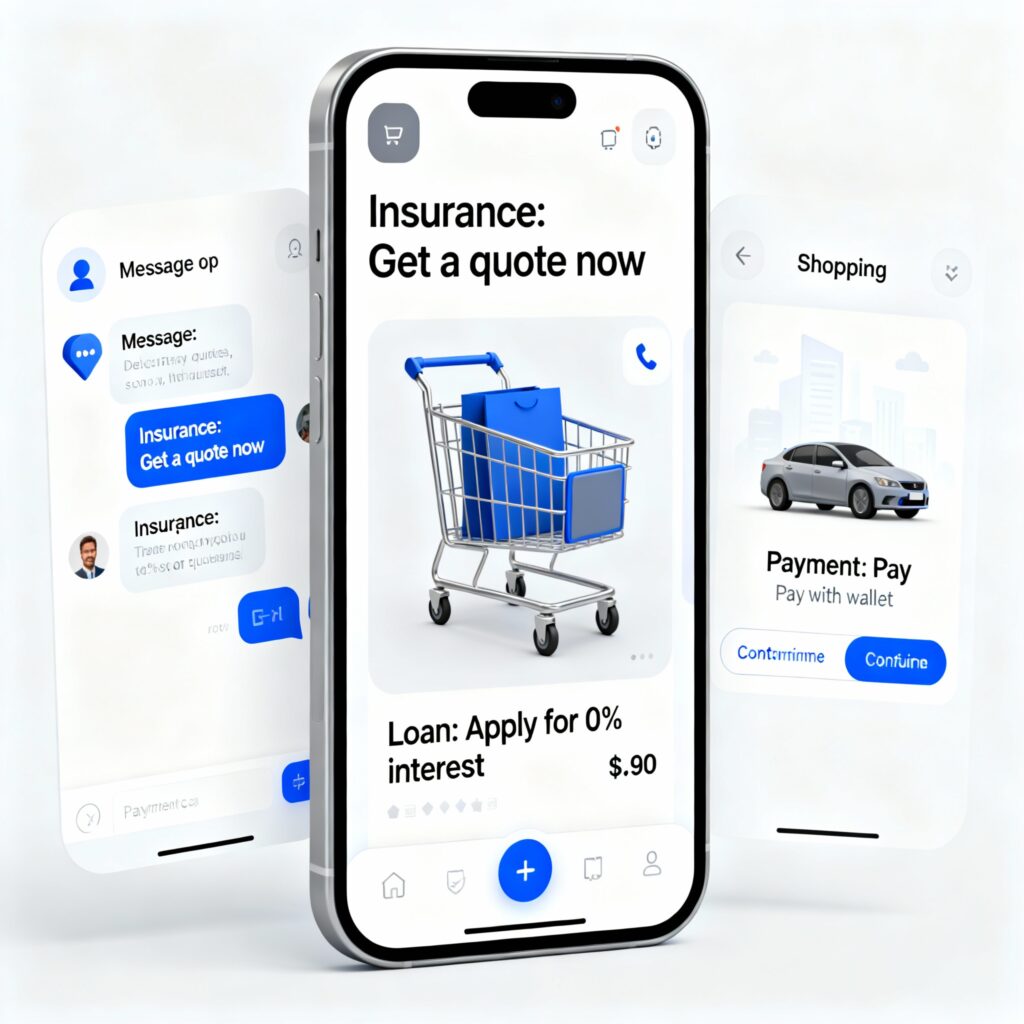

Embedded Finance and Seamless Integration

Embedded finance is a leading trend driving fintech growth, where financial services such as payments, loans, and insurance are integrated directly into non-financial platforms. This creates seamless customer experiences—for example, allowing users to access credit or insurance from e-commerce or ride-hailing apps without switching platforms. In markets like India, super apps such as Paytm and PhonePe are exemplifying this trend by embedding diverse financial services for convenience and financial inclusion.

Next-Gen Digital-Only Banks

Digital-only banks are gaining traction with enhanced offerings combining blockchain, cryptocurrencies, and AI-driven customer service. These banks focus on niche segments and hyper-personalized financial products, avoiding the pitfalls of global geographic expansion by instead deepening product portfolios for affluent segments and growing deposit bases.

Payment Innovations and Instant Payments

Instant payments continue to grow, supported by regulations like the EU’s Instant Payments Regulation and standardized messaging protocols such as ISO 20022. Cross-border payments are being streamlined with Request-to-Pay technologies, reducing friction in international transactions. Virtual cards and digital wallets like Apple NFC are also revolutionizing B2B expenses and consumer payments by enabling faster, safer, and more personalized payment experiences.

Regulatory Landscape and Compliance Tech

Fintech companies face rising regulatory scrutiny, with mandates such as the Digital Operational Resilience Act (DORA) and PSD3 advancing compliance demands. This has pushed fintechs to adopt RegTech solutions that leverage AI to automate compliance, real-time risk management, and enhance cybersecurity. Firms must balance innovation with regulatory adherence to succeed in the evolving landscape.

Tokenization and Onchain Finance

Onchain finance, powered by blockchain, holds promise for transforming asset management by tokenizing illiquid assets such as real estate and bonds. This innovation aims to reduce settlement times, minimize intermediaries, and expand economic activity on blockchain networks. However, challenges remain around scalability, infrastructure, standards, and regulatory clarity.

Sustainability and Green Finance

Sustainability is becoming a critical differentiator in fintech. Green finance and ESG (Environmental, Social, Governance) considerations are driving product design, with APIs enabling ESG scoring, green portfolios, and climate-aware lending. This trend reflects growing consumer and investor demand for responsible finance solutions.

Growing Market and Investment Trends

Global fintech funding remains robust though more selective, with increased activity in digital assets and IPOs. Fintech is projected to grow significantly in market valuation, and mergers and acquisitions are rising, driven by strategic consolidations and technological innovations.

This overview highlights how fintech in 2025 is evolving through technological innovation, expanding embedded finance, regulatory advancements, and new market dynamics. These trends are shaping a future where financial services become more integrated, intelligent, personalized, and accessible.

If needed, a detailed analysis or focus on specific fintech subsectors can be provided to deepen insights.

This blog synthesizes insights from recent authoritative sources on fintech trends in 2025.