Opening a bank account with HDFC Bank is easy and convenient with options to apply online or offline. Whether you want a savings account, salary account, or zero-balance account, this guide covers everything you need to know to open your HDFC Bank account smoothly.

Why Choose HDFC Bank?

- Leading private sector bank in India with a wide range of products

- Quick account activation and excellent digital banking facilities

- Multiple account types tailored to different needs

Documents Required to Open an HDFC Bank Account

- Proof of Identity (Aadhaar card, PAN card, Passport, Voter ID, Driving License)

- Proof of Address (Utility bill, Rent agreement, Passport, Aadhaar)

- Passport-size photographs (usually 1 or 2)

- Mobile number linked with Aadhaar (for online verification)

- Optional: PAN card or Form 60 if PAN is not available

Step-By-Step Process to Open an HDFC Bank Account Online

Step 1: Visit HDFC Bank’s Official Website

Go to the HDFC Bank website and navigate to the ‘Save’ section, then select “Savings Account.”

Step 2: Select Account Type and Click ‘Apply Online’

Choose the savings account type that suits you best and click on “Open Instantly.”

Step 3: Enter Required Details

Provide your Aadhaar-linked mobile number, date of birth, full name, and other personal details as requested.

Step 4: Verify Your Mobile Number

An OTP will be sent to your registered mobile number. Enter the OTP to verify your number.

Step 5: Submit Aadhaar Details for e-KYC

Enter your Aadhaar number and complete the e-KYC process by submitting OTP received on your Aadhaar-registered mobile.

Step 6: Complete Additional Details

Fill in details such as address, nominee information, and select your preferred branch.

Step 7: Video Verification

A bank representative will contact you for a short video call to verify your identity and complete KYC verification.

Step 8: Account Activation and Welcome Kit

Once verified, your account will be activated. You will receive a welcome kit containing ATM/debit card, cheque book, and PIN at your registered address.

Step-By-Step Process to Open an HDFC Bank Account Offline

Step 1: Visit the Nearest HDFC Bank Branch

Ask for an account opening form.

Step 2: Fill the Application Form

Accurately fill out the form with your personal and KYC details.

Step 3: Submit Documents and Form

Submit your form along with identity and address proofs to the bank staff.

Step 4: Verification and Activation

The bank will verify your documents and contact you if required for any additional checks.

Step 5: Receive Welcome Kit

After approval, you will receive your account details, debit card, and cheque book.

Key Benefits After Opening an HDFC Bank Account

- Easy online and mobile banking access

- Wide ATM and branch network

- Multiple account variants like Zero Balance, Kids Account, Senior Citizen, and more

- Secure transactions with instant alerts

Suggested Images for the Blog

- Screenshot of HDFC Bank official website’s account opening page.

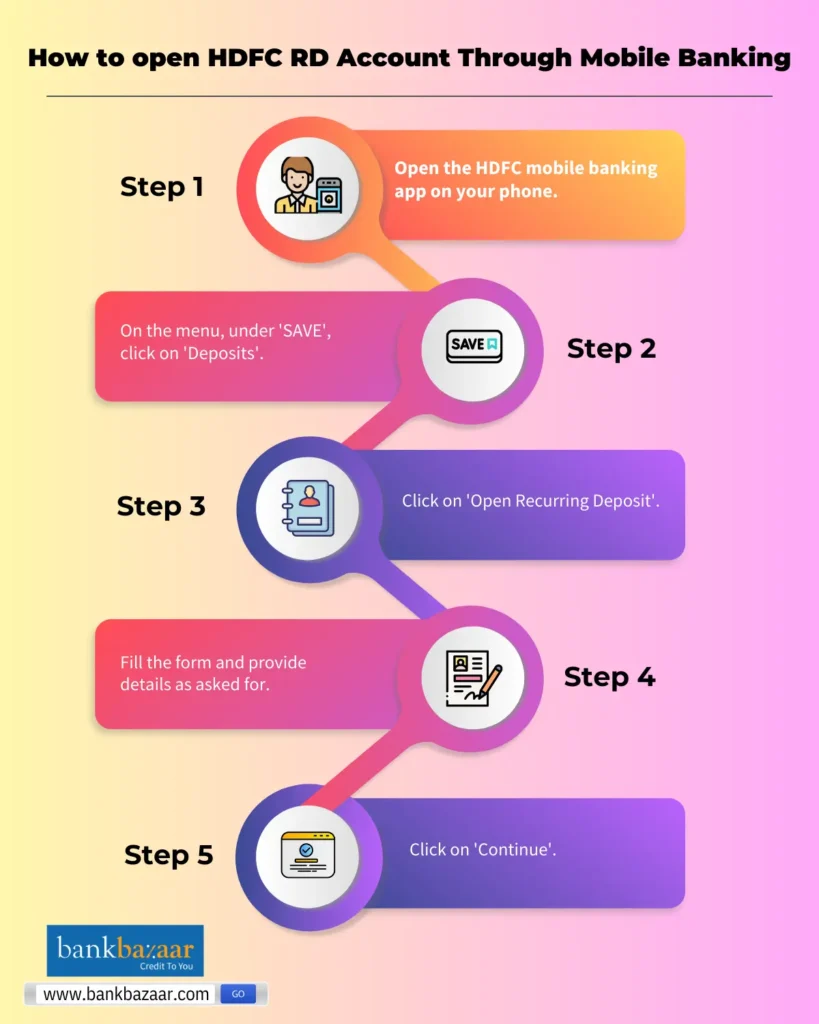

- Stepwise infographic showing the online account opening process.

- Sample Aadhaar and PAN card images for documents required (ensure generic versions).

- Picture of a happy customer holding an HDFC Bank debit card.

- Image of HDFC Bank welcome kit (cheque book, debit card, etc.).

- A video call screen representing the KYC verification process.

Opening an HDFC Bank account is now hassle-free with digital options. Whether online or offline, this guide ensures you understand every step to get your account activated quickly and start banking smoothly.