Building an Emergency Fund: Your Safety Net for Uncertain Times

Life is unpredictable. From sudden medical expenses to unexpected job loss, emergencies can arise when we least expect them. That’s where an emergency fund comes in — a dedicated savings cushion designed to help you navigate financial setbacks without relying on debt or high-interest credit.

In this blog, we’ll explore why an emergency fund is essential, how much you should save, and practical steps to build one.

Why You Need an Emergency Fund

An emergency fund provides peace of mind and financial stability during uncertain times. It allows you to cover:

- Medical emergencies such as hospital bills or medicine.

- Job loss or reduced income without having to borrow money.

- Unexpected home or car repairs that demand immediate attention.

- Family or personal emergencies like travel expenses for urgent situations.

Without a savings buffer, these events can derail your financial goals and push you into debt.

How Much Should You Save?

The ideal size of an emergency fund depends on your income, expenses, and lifestyle. A common guideline is:

- Minimum amount: At least 3 months of living expenses.

- Comfort zone: 6 months of expenses for better security.

- Extra cautious approach: 9–12 months if you are self-employed, freelancing, or in an unstable job sector.

For example, if your monthly expenses are ₹40,000, aim for an emergency fund between ₹1,20,000 to ₹2,40,000.

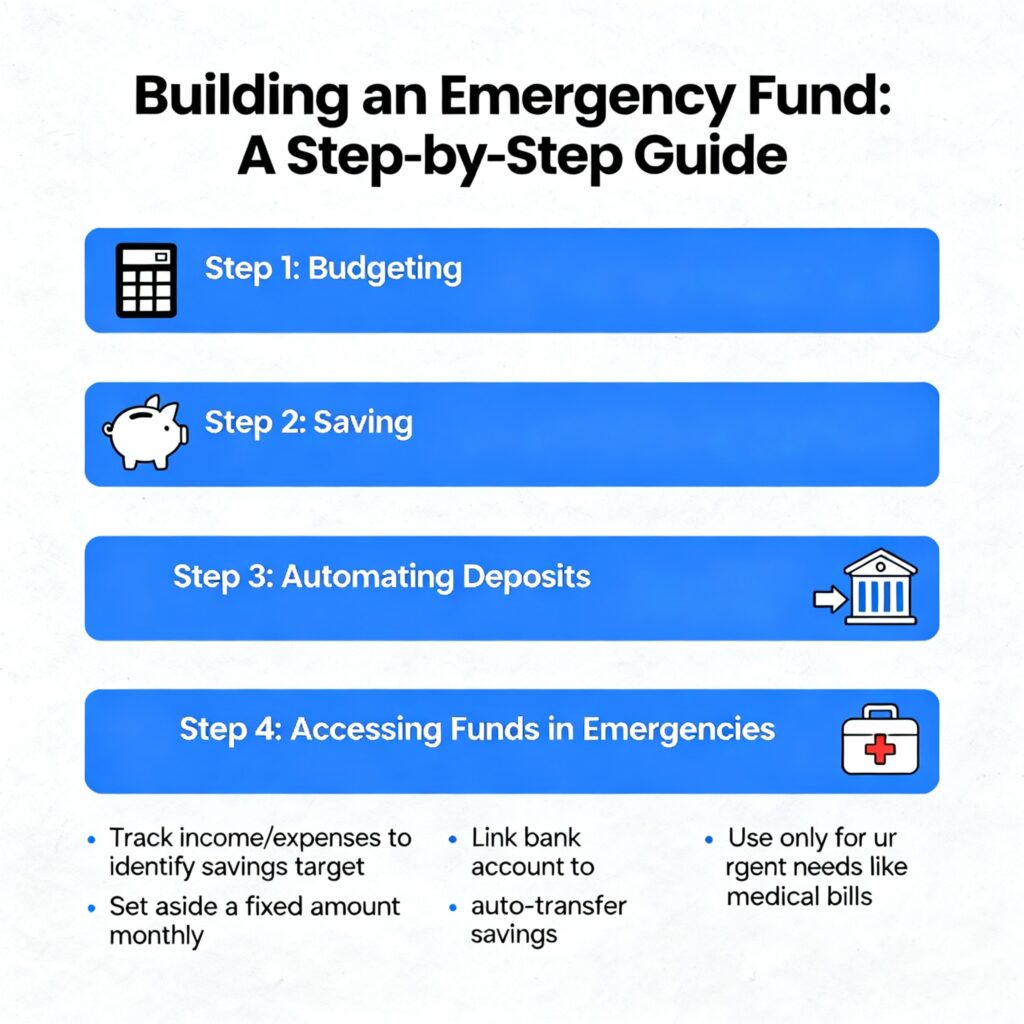

Steps to Building an Emergency Fund

1. Assess Your Expenses

Start by calculating your essential monthly costs such as rent, food, utilities, transportation, and insurance. This helps you set a realistic savings goal.

2. Start Small and Be Consistent

If saving a large sum feels overwhelming, begin with a smaller target (like ₹5,000 or ₹10,000). Consistent deposits, even small ones, add up over time.

3. Automate Your Savings

Set up an automatic transfer to a separate savings account every month. Treat it like a non-negotiable bill.

4. Use the Right Account

Keep your emergency fund in a high-interest savings account, fixed deposit, or liquid mutual fund. Avoid riskier investments like stocks — the fund must always be accessible.

5. Avoid Temptation

Resist dipping into your emergency fund for non-essentials like gadgets or holidays. Its sole purpose is to protect you in times of crisis.

Tips to Grow Your Emergency Fund Faster

- Use bonuses, tax refunds, or windfalls to boost savings.

- Cut down on discretionary spending for a few months.

- Take up a side hustle and direct the extra income into your emergency fund.

Final Thoughts

An emergency fund is not just about money; it’s about security, stability, and confidence. By planning ahead and setting aside a dedicated financial buffer, you give yourself the power to face life’s uncertainties without panic or debt.

Remember — the best time to start building your emergency fund is today. Even the smallest step counts toward financial freedom.