Here is a comprehensive guide to buying your first home in 2025:

Assess Financial Readiness

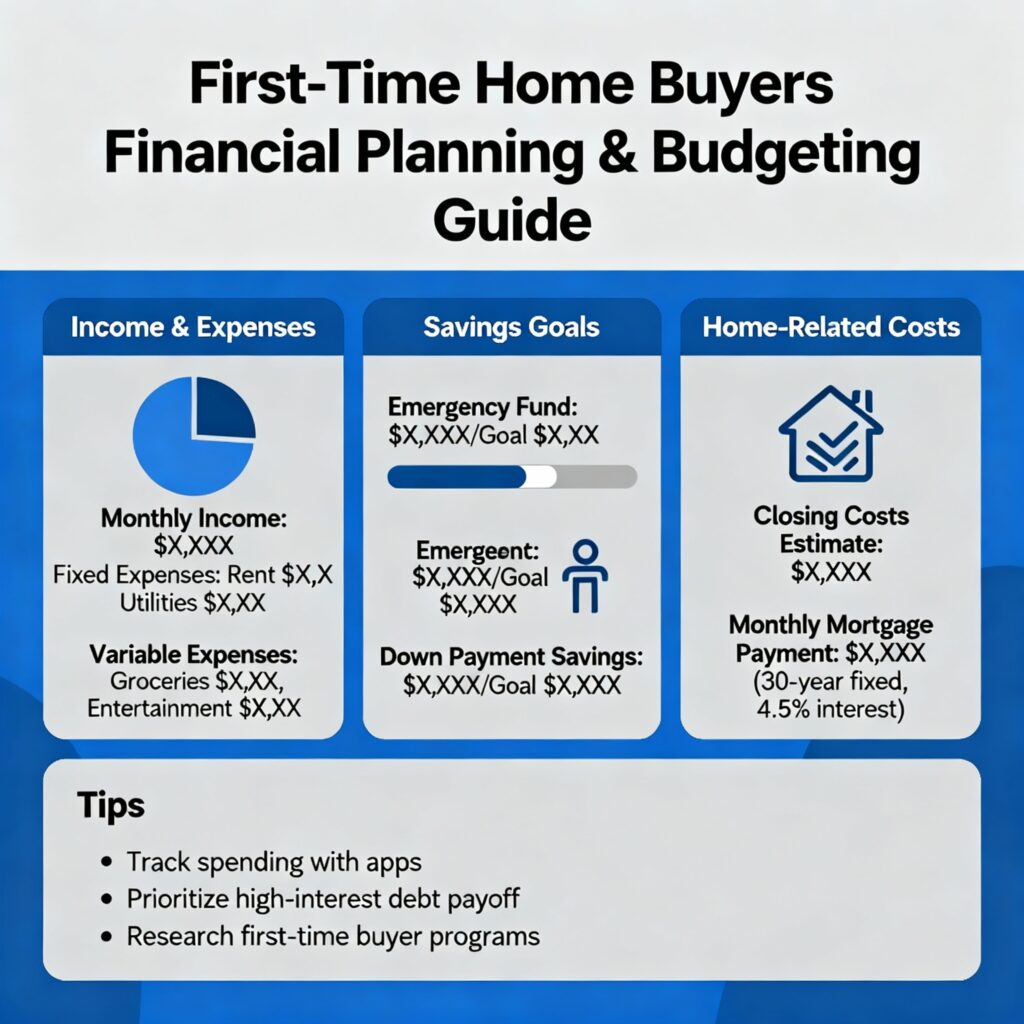

Make sure you are financially prepared by reviewing your income, expenses, savings, and debts. Check your credit score, as it affects mortgage approval and interest rates. Experts recommend housing costs (mortgage, taxes, insurance) not exceed 20-30% of your gross monthly income. Maintain an emergency fund covering 6-12 months of expenses. Plan for a down payment of at least 10-20% of the property’s value to reduce loan burden.

Define Your Home Needs

Determine your budget, lifestyle, and future plans to decide on the type of property (apartment, row house, villa), size, and preferred location. Consider proximity to workplaces, schools, hospitals, and transport hubs. Look for emerging localities with growth potential for better long-term value.

Research and Shortlist Properties

Explore real estate market trends and compare property prices. Verify developer reputation and project credentials. Use technology like online property portals and virtual tours to ease your search.

Financing and Mortgage

Get pre-approved for a mortgage by gathering financial documents and approaching multiple lenders. Compare home loan interest rates and types (fixed, floating). Understand available government schemes and eligibility. A pre-approval strengthens your buying position.

Legal and Regulatory Checks

Ensure the property has clear titles, proper approvals, and is registered under RERA (Real Estate Regulatory Authority). Verify occupancy certificates and compliance with local laws to prevent future disputes.

Home Inspection

Hire a professional home inspector to check for structural defects, plumbing, electrical wiring, and overall condition before finalizing the purchase.

Consider Sustainability and Technology

Look for energy-efficient features like solar panels and rainwater harvesting. Check for smart home features and high-speed internet availability for modern living.

Final Purchase and Registration

Conduct a final inspection, negotiate terms and price, and ensure payment of stamp duty, registration fees, and taxes. Get the property officially registered in your name and consider home insurance for protection.

Common Mistakes to Avoid

Avoid skipping financial and legal checks, underestimating hidden costs (maintenance, legal fees, taxes), and ignoring resale potential or location importance.