Surviving Inflation: Financial Planning in 2025

Inflation continues to challenge households and investors in 2025, squeezing budgets and eroding the purchasing power of savings. While inflation has somewhat eased from previous highs, it remains above historical averages, making smart financial planning more critical than ever. This blog will guide through practical and actionable steps to protect your finances and even thrive amid inflationary pressures.

Understand the Impact of Inflation

Inflation means the cost of goods and services rises over time, diminishing the value of your money. Without mitigation, this can reduce your standard of living and undermine your financial goals. Recognizing inflation as a key factor in financial planning allows you to make adjustments proactively rather than reactively.

Reassess Your Budget Regularly

Prices on groceries, utilities, insurance, and other everyday expenses fluctuate and often trend upward with inflation. It’s essential to:

- Review your budget at least quarterly.

- Differentiate between fixed and variable expenses.

- Cut unnecessary discretionary spending like redundant subscriptions or unused memberships.

- Adjust your savings and spending targets to keep pace with inflation.

By staying vigilant, you maintain control over your cash flow and avoid slipping into lifestyle inflation that outpaces earnings.

Keep Cash Reserves Strategic

While having an emergency fund with 3–6 months of essential expenses is vital, avoid hoarding excess cash since it loses value over time due to inflation. Instead, keep emergency savings in high-yield savings accounts or money market funds to earn interest that partially offsets inflation erosion.

Invest to Outpace Inflation

Investments are a frontline defense against inflation’s corrosive effects. Consider the following options:

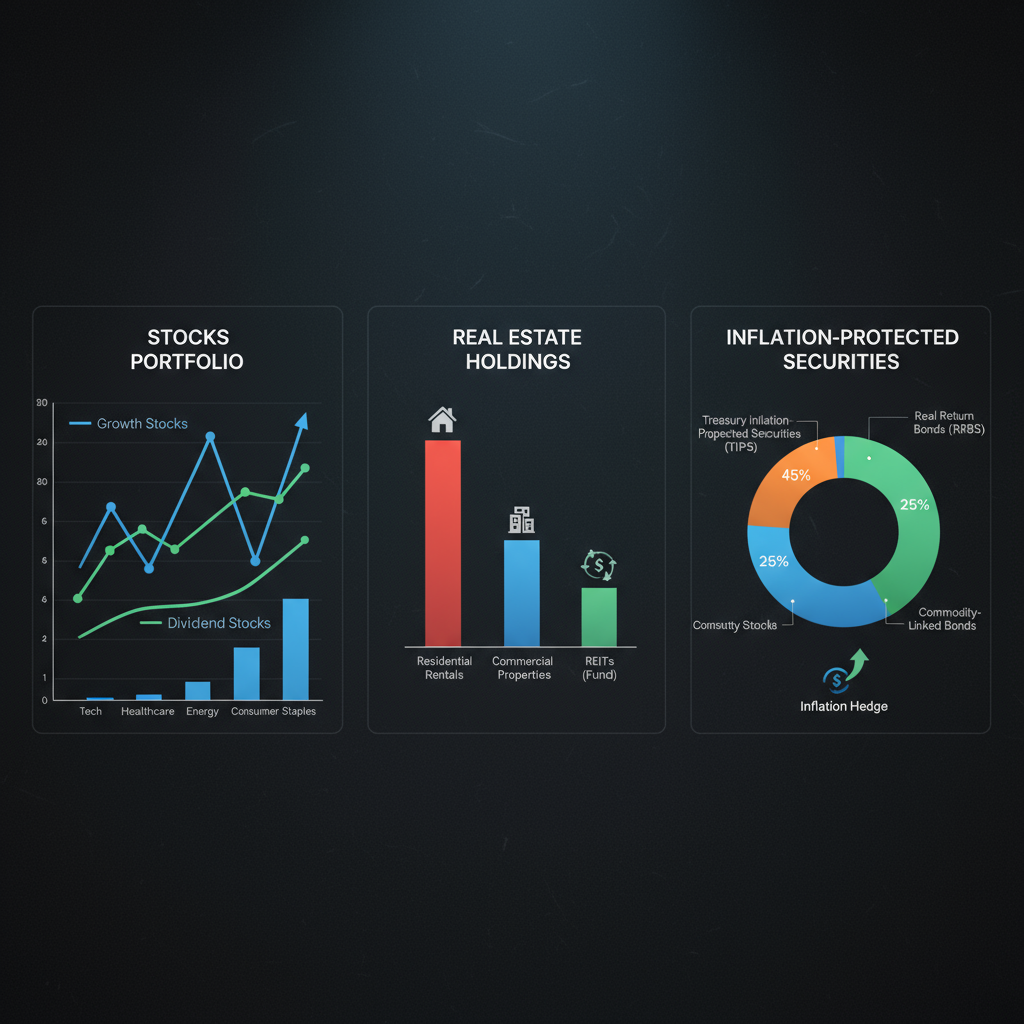

- Equities: Historically, stocks have outperformed inflation over the long term, thanks to economic growth and corporate earnings increases.

- Real Assets: Real estate and commodities like precious metals tend to keep value or appreciate during inflationary periods.

- Treasury Inflation-Protected Securities (TIPS): Government securities designed to protect principal and interest payments against inflation.

- Diversification: Explore international markets, high-yield bonds, and alternative assets to spread risk and capture growth opportunities.

Align your investment strategy with your financial goals, risk tolerance, and values for sustainable results.

Build Flexible Income Streams

Inflation diminishes the value of fixed income sources. To guard against this:

- Develop income streams that can grow over time, such as rental properties, dividend-paying stocks, or side businesses.

- If near retirement, focus on income solutions that preserve buying power, not just nominal cash flow.

Beware Lifestyle Creep

It’s tempting to increase spending as income rises during inflationary times, but this can undermine savings and wealth-building. Use salary raises or bonuses primarily to boost savings or investments, rather than expanding your lifestyle. Contentment can be a powerful financial hedge.

Review Insurance and Estate Plans

Inflation affects replacement costs and asset values:

- Update life, home, and liability insurance coverage accordingly.

- Adjust estate plans for current asset values and tax scenarios to ensure your legacy planning remains effective.

Additional Tips to Navigate Inflation

- Be an intelligent shopper, seeking deals and optimizing grocery runs.

- Negotiate mortgage and rent if possible.

- Prioritize paying down high-interest variable debt, like credit cards, to reduce cost burdens.

- Keep informed of inflation trends and adjust plans as necessary.

By taking a thoughtful, proactive approach to budgeting, investing, and income management, you can protect your financial well-being from inflation’s effects and position yourself for long-term success in 2025 and beyond.