Complete Guide to Securing Your Future

Retirement is a major milestone that everyone dreams of, but only effective planning can turn it into a financially stress-free stage of life. Whether you’re just starting your career or already in your 40s and 50s, it’s never too early—or too late—to prepare for retirement.

Why Retirement Planning Matters

Many people underestimate retirement expenses, thinking they will need less money once they stop working. In reality, costs like healthcare, inflation, and lifestyle aspirations can make your retirement years just as expensive, if not more. A clear plan ensures financial security, independence, and peace of mind without depending on others.

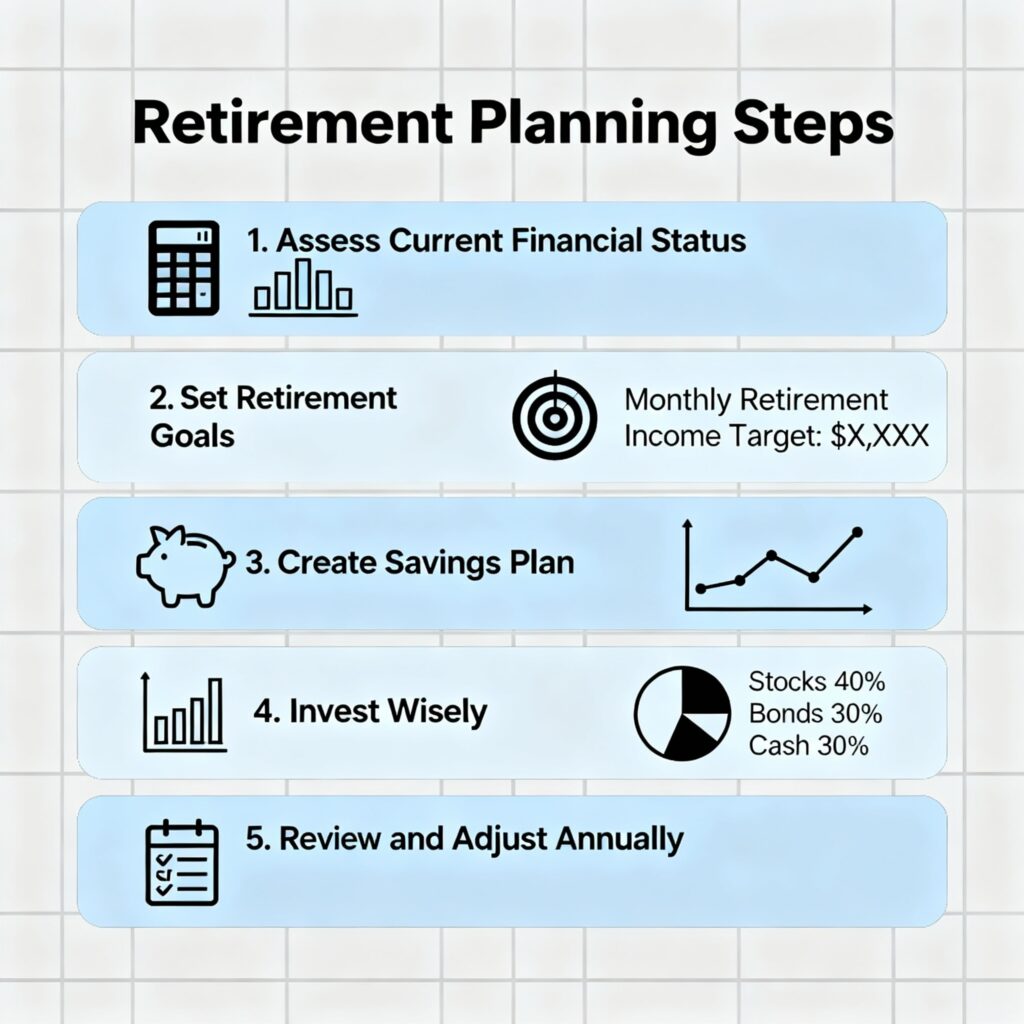

Key Steps in Retirement Planning

- Define Your Retirement Goals

Decide the age you’d like to retire, the lifestyle you want, and whether you plan on relocating, traveling, or starting a side business. - Estimate Your Retirement Expenses

Make a realistic assessment of your post-retirement costs, including basic living expenses, healthcare, recreation, and unexpected emergencies. - Calculate Your Retirement Corpus

Use retirement calculators to estimate how much you need. A common rule of thumb is the 4% withdrawal rule, which allows you to live on 4% of your savings annually. - Start Early and Invest Wisely

The earlier you begin, the more you benefit from compounding. Focus on a diversified portfolio—mutual funds, stocks, retirement accounts, insurance, and fixed-income investments. - Build an Emergency Fund

Keep at least 6–12 months of expenses aside in a liquid account to handle unforeseen circumstances. - Consider Inflation and Healthcare

Ensure your retirement plan factors in rising inflation rates and medical expenses, which can significantly impact your savings. - Review and Adjust Regularly

Life changes—new responsibilities, market fluctuations, or shifting goals mean your retirement plan should be reviewed and adjusted at least once a year.

Smart Retirement Planning Tools

- Provident Funds (EPF/PPF/NPS) – Government-backed, low-risk retirement options.

- Mutual Funds and SIPs – Great for long-term wealth creation with flexibility.

- Insurance Plans – Health and term insurance safeguard your savings.

- Pension Schemes – Provide a steady income post-retirement.

Common Mistakes to Avoid

- Starting too late and relying only on savings.

- Ignoring inflation and healthcare costs.

- Not diversifying investments.

- Withdrawing retirement funds too early.

Final Thoughts

Retirement planning is not just about money—it’s about lifestyle, security, and having the freedom to do what you love without financial worries. The best time to start planning is today, regardless of your age or income. Remember, disciplined saving and smart investing can transform your golden years into a truly fulfilling and stress-free chapter of life.